Bank for International Settlements (BIS)

Established in 1930, the Bank for International Settlements (BIS) is owned by 63 central banks, including the Board of Governors of the Federal Reserve System (United States), representing countries from around the world that together account for about 95% of world GDP. Its head office is in Basel, Switzerland and it has two representative offices: in Hong Kong SAR and in Mexico City, as well as innovation Hub Centers around the world.

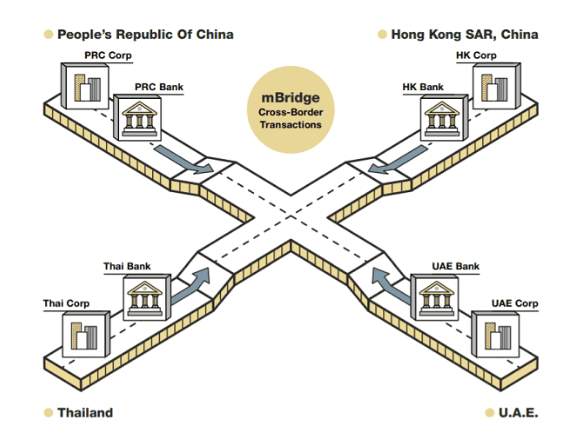

The BIS mBridge Ledger project is run as part of the Hong Kong BIS Innovation Hub, and it recently launched a minimum viable product (MVP).

As of August 2024, the observing members to Project mBridge includes the Federal Reserve Bank of New York. There are also now more than 31 observing members.

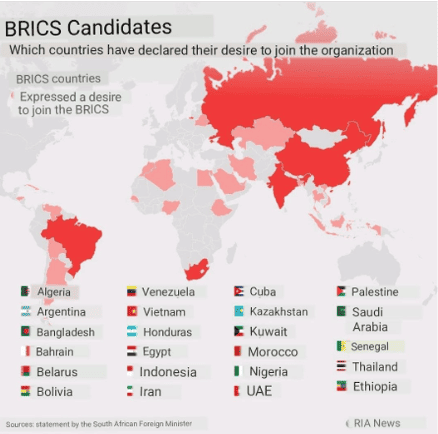

In conjunction with the BIS, the BRICS organization has established a BRICS Bridge digital currency platform to support trade with local currencies.

Known as the BRICS Project mBridge Ledger, this multi-sided payment platform connects member states’ financial systems using payment gateways for settlements in central bank digital currencies.

The NewYork Federal Reserve and Regulated Liability Network

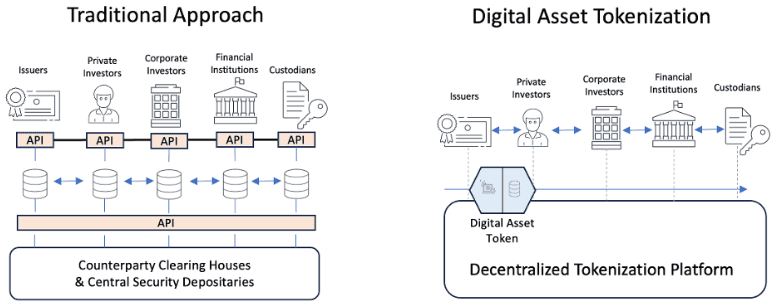

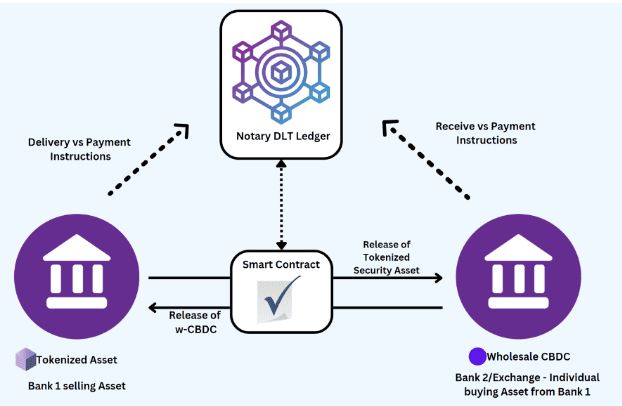

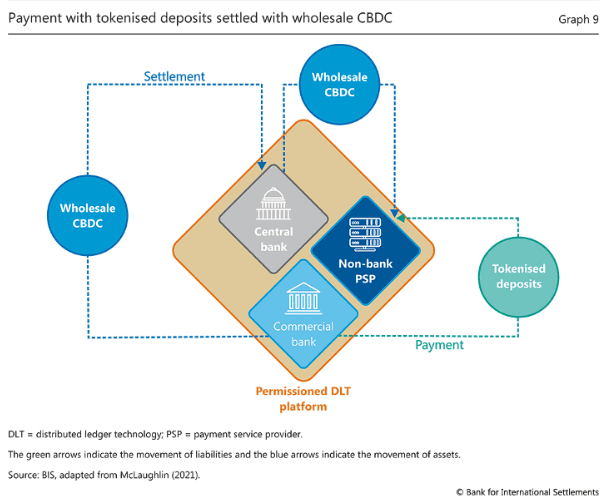

The New York Federal Reserve`s New York Innovation Center (NYIC), in collaboration with members of the U.S. financial services sector, participated in a proof of concept that experimented with the concept of a Regulated Liability Network (RLN). The RLN concept envisions a theoretical payment infrastructure designed to support the exchange and settlement of regulated digital assets using distributed ledger technology (DLT).

The NYIC`s role in this project is narrowly focused on observing the participants’ research and experimentation with tokenized settlement assets.

The NYIC is a technical observer in a subsequent industry proof of concept that will further explore the feasibility of a theoretical payment infrastructure designed to support the exchange and settlement of regulated digital assets. The NYIC is a technical observer in this proof-of-concept to gain knowledge on the use of shared ledger technology as infrastructure to conduct transfers between regulated financial institutions, including settling tokenized wholesale central bank money, commercial bank money, and U.S. Treasury securities.

The RLN U.S. Working Group is engaged in a proof of concept to explore the business applicability, technical feasibility, and legal viability of the RLN concept in the U.S. context. The PoC was limited to domestic and international payments denominated in U.S. dollars. To test the Regulated Liability Network(RLN) concept, the proof of concept working group researched and analyzed the technical feasibility, business applicability, and legal viability of the concept.

The experiment successfully simulated both the domestic and cross-border scenarios, identifying shared ledger technology as a potential solution to support payment innovation.

Existing payment systems work through the orchestration of debits and credits across thousands of separate, proprietary bank ledger systems. The RLN concept explores the application of shared ledger technology to change this paradigm, potentially leading to a simpler way of synchronizing payments and settlements across the banking industry.

RLN imagines a new financial market infrastructure that runs a shared ledger for participants. On this ledger, there are digital representations of central bank money and commercial bank deposit tokens. This creates an interoperable network for efficient settlement that might be extended to multiple currencies and assets.

National Sovereignty

BRICS’ forms a coalition of sovereign state countries participating in the UNIT ecosystem of policy independence.

The UNIT ecosystem rule book would be focused on reserve basket composition and ecosystem operations. It will not impose EU-type market rules and regulations on participants.

Each country would be free to pursue national economic policies it deems to be in its interest . Countries can continue to implement what ever trade and regulatory policies they want.

The UNIT system does not require a country to peg its currency to other currencies. In terms of monetary policy, a country can set its own standards.

However, gold will require discipline and restrictions for participating countries with trade deficits. If a country has a trade deficit, it will likely wish to put as much of its own currency (as allowed by the “rule book ” ) on reserve at a node to obtain UNITs. However, high domestic inflation would likely make UNITs more expensive in local terms as its currency depreciates against gold.

BRICS Economics and The Global Geopolitical Landscape

BRICS represents a competing global narrative to that of the West. With regard to the balance of power, it involves changing the agenda, direction, and geopolitical standing of the U.S. dollar.

BRICS` impact can be evaluated based on the degree of political coherence among them, as well as their capacity to influence the global economic system.

BRICS member nations form a growing coalition of competing power switch a common political objective: to erode Western hegemonic claims by protecting the political sovereignty of nations.

Russia is advancing two key strategic goals with its membership in BRICS. First, the political leadership is establishing multi-lateral agreements for the sales of its natural gas to Europe and elsewhere. Secondly, Russia and China are leading in efforts to establish BRICS as the geopolitcial alternative to Western countries.

BRICS members have reached an agreement to settle trade between them using their individual sovereign currencies in the future. This, already, has taken place between China and Saudi Arabia, signifying more international payments will be made using the Chinese yuan (renminbi) in opposition to the

U.S. dollar. China’s economy is counted as larger than that of Brazil, India, Russia and South Africa com bined. China’s political leadership views their membership in BRICS as a hedge against international sanctions.

The New Development Bank (NDB), formerly referred to as the BRICS Development Bank, is a multilateral development bank established by the BRICS states of Brazil, Russia, India, China, and South Africa.

According to the Agreement on the NDB, “the Bank shall support public or private projects through loans, guarantees, equity participation and other financial instruments.” Moreover, the NDB “shall cooperate with international organizations and other financial entities, and provide technical assistance for projects to be supported by the Bank.”

The bank is headquartered in Shanghai, China. The first regional office of the NDB is in Johannesburg, South Africa. The second regional office was established in 2019 in São Paulo, Brazil, followed by GIFT City, India and Moscow, Russia.

The Agreement on the New Development Bank entered into force in July 2015, with the official declaration of all five states that have signed it. The five founding members of the Bank include Brazil, Russia, India, China and South Africa.

The bank is headquartered in Shanghai, China. The first regional office of the NDB is in Johannesburg, South Africa.

The second regional office was established in 2019 in São Paulo, Brazil, followed by GIFT City, India and Moscow, Russia.

The NDB’s Articles of Agreement specify that all members of the United Nations could be members of the bank, however the share of the original BRICS group can never be less than 55% of total voting power. The current voting power of the original five members is more than 90%.

The initial authorized capital of the bank is $100 billion divided into 1 million shares having a par value of $100,000 each. The initial subscribed capital of the NDB is $50 billion divided into paid-in shares ($10 billion) and callable shares ($40 billion). The initial subscribed capital of the bank was equally distributed among the founding members (Brazil,

Russia, India, China, South Africa). The Agreement on the NDB specifies that every member will have one vote and that no member would have any veto powers.

The aim of BRICS is to become more independent of the previously dominant role of Western financial and capital markets. New payment flows and funds are to be created through the establishment of a BRICS currency as an alternative to the dollar, a stronger handling of intra-BRICS trade in their own currencies, and a stronger capitalization of the New Development Bank (NDB) as BRICS’ own development bank.